Profit Margin Calculator

Squeeze more profit from every sale! Track your margins with this calculator!

What is Profit Margin?

Stop Guessing, Start Knowing: Illuminate Your Path to Profitability with the Profit Margin Calculator

Tired of wondering if your business is truly generating the profits it deserves? Ready to shed light on the hidden drivers of financial success, uncover areas for improvement, and make strategic decisions that propel your business towards a future of abundant rewards? Introducing the Profit Margin Calculator, your secret weapon to master financial performance, diagnose revenue leaks, and transform your business into a profit-generating powerhouse.

Here's why it's your indispensable guide to profitability mastery:- Measure What Matters Most: Calculate your profit margin with precision, revealing the percentage of revenue that translates into actual profit, providing a crucial benchmark for understanding financial health, identifying growth opportunities, and making informed strategic decisions. Know your numbers, know your worth.

- Spot Hidden Profit Leaks: Analyze your profit margin across different products, services, or business units to uncover areas where costs are cutting into profits, allowing you to proactively address inefficiencies, optimize spending, and maximize profitability. Plug the leaks and unleash your earning potential.

- Experiment with Pricing Strategies: Test the impact of different pricing models on your profit margin, finding the optimal balance between revenue generation and cost control to boost profitability and strengthen your competitive edge. Price for profit, not just sales.

- Negotiate Better Deals: Use insights from the calculator to negotiate more favorable terms with suppliers and vendors, reducing costs of goods sold and directly increasing your profit margin. Leverage data to strengthen your bargaining power.

- Track Progress and Identify Trends: Monitor profit margin trends over time to evaluate the effectiveness of your cost-cutting measures, pricing strategies, and operational improvements. Stay agile, adapt your approach, and continuously refine your path to profitability.

The Profit Margin Calculator is more than just a tool—it's your financial guardian, your profitability strategist, and your key to unlocking the hidden wealth within your business operations.

Remember

In business, revenue is vanity, but profit is sanity. And the Profit Margin Calculator empowers you to cut through the noise, focus on what truly matters, and transform your business from a revenue-generating machine into a profit-maximizing force. Embrace the clarity and confidence it provides. Start using the calculator today and start calculating the path to financial abundance, transforming uncertainty into profitable action, and building a business that not only generates revenue, but also secures lasting profitability, fuels sustainable growth, and delivers the rewards you deserve!

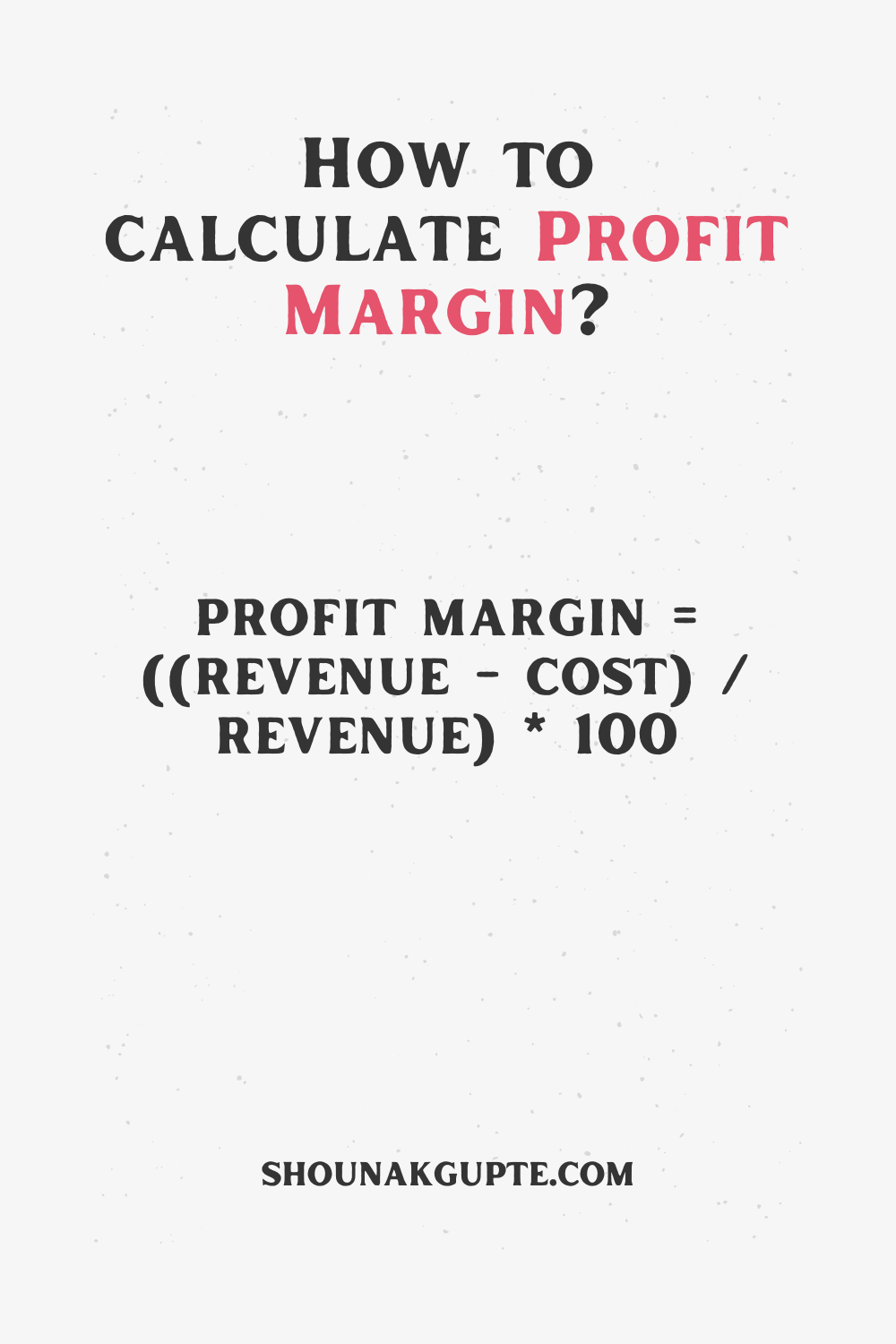

Profit Margin Formula - How To Calculate Profit Margin?

Help!

Revenue: The total amount of income generated. Valid inputs are positive numbers.Cost: The total expenses incurred. Valid inputs are positive numbers.

Profit: The net benefit after subtracting all costs from revenue. It reflects whether a business is operating profitably (positive profit), making no profit (zero profit), or incurring losses (negative profit).

Your Input

The Profit is $0.

The Profit Margin is 0%

Benchmarks!

Unfortunately, pinpointing an "average" profit margin for all businesses is impossible due to immense variation across industries, business models, accounting practices, and even company size. However, some general observations can be made:- Healthy businesses: Generally aim for profit margins above 10%, with some high-performing companies achieving significantly higher margins depending on their industry and specific business model.

- Low-margin industries: Certain industries, like retail or grocery, might have average profit margins closer to 5% or even lower due to high competition and operational costs.

- High-margin industries: Certain industries, like technology or pharmaceuticals, can have average profit margins exceeding 20% or even 30% due to specialized products, high barriers to entry, and strong intellectual property.

Success

Related Calculators

Accounts Receivable Calculator

Turn outstanding debts into cash flow magic! Master your AR like a pro with this calculator!

Click HereAccounts Receivable Turnover Ratio Calculator

Track your cash flow magic! See how quickly you collect payments with this Accounts Receivable Turnover Ratio Calculator.

Coming soonAnnual Recurring Revenue (ARR) Calculator

Predict your predictable profits! See your ARR soar with this growth calculator!

Click HereAverage Order Value (AOV) Calculator

Boost your basket size! Watch AOV soar and profits bloom with this calculator!

Click HereAverage Revenue Per User (ARPU) Calculator

Squeeze more value from every user! Watch ARPU soar with this calculator!

Click HereBreak-Even Point (BEP) Calculator

Find your profit paradise! Discover your BEP with this calculator!

Click HereBusiness Viability Calculator

Seed your idea, harvest success! This calculator predicts your business bloom or bust!

Click HereCart Abandonment Rate Calculator

Rescue those runaway carts! Slash abandonment rates and boost profits with this calculator!

Click HereCash Runway Calculator

Map your financial moonwalk! Track your cash flow and see how far your runway stretches with this calculator!

Click HereChurn Rate Calculator

Stop the customer stampede! Track churn and keep loyalty burning with this calculator!

Click HereCommission Calculator

Turn hard work into sweet rewards! Track your commission with this handy calculator!

Click HereCustomer Acquisition Cost (CAC) Calculator

Know your worth, win more customers! Track your CAC like a pro with this calculator!

Click HereCustomer Lifetime Value (CLV) Calculator

Predict customer goldmines! Mine lifetime value with this CLV calculator!

Click HereEarnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) Calculator

Gauge your company's financial health in a flash! Track your earnings before the extras with this handy EBITDA calculator!

Click HereEmployee Turnover Cost Calculator

Stop the revolving door! Track turnover costs and keep your team thriving with this calculator!

Click HereGoods and Services Tax (GST) Calculator

Ditch tax drama! Calculate your GST in a flash with this magic tool!

Click HereHiring Cost Calculator

Hire smarter, spend less! Track hiring costs and find top talent with this calculator!

Click HereInventory Management Calculator

Stock smart, sell savvy! Optimize inventory & profits with this calculator!

Click HereInventory Turnover Rate (ITR) Calculator

Sell fast, stock smart! Track inventory turnover with this calculator!

Click HereLease vs Buy Calculator

Rent or own? Weigh your wheels with this Lease vs. Buy Calculator!

Coming soonMarkup Calculator

Turn cost into profit magic! Master your margins with this Markup Calculator!

Click HereMonthly Recurring Revenue (MRR) Calculator

Predict your predictable profits! Watch MRR climb with this subscription growth tracker!

Click HereNet Promoter Score (NPS) Calculator

Gauge brand love in a snap! Track NPS and see how your customers truly feel!

Click HereOpportunity Cost Calculator

Ditch "what ifs" and weigh your wins! See what could be with this Opportunity Cost Calculator!

Click HerePayroll Calculator

Pay your team with precision! Track costs and paychecks flawlessly with this calculator!

Coming soonProfit Increase Calculator

Unleash your profit potential! Track your growth with this Profit Calculator!

Click HereProfit Loss Calculator

Track your financial health from green to green-er with this Profit & Loss calculator!

Click HereProfit Margin Calculator

Squeeze more profit from every sale! Track your margins with this calculator!

Click HereRatio of Customer Lifetime Value(CLTV) to Customer Acquisition Cost (CAC) Calculator

Mine customer gold vs. dig acquisition costs! This calculator reveals your CLTV:CAC treasure ratio!

Click HereRetention Rate Calculator

Keep your customers close! Track retention rates and build loyalty with this calculator!

Click HereRevenue Projection Calculator

Predict your financial future like a pro! Track your growth with this Revenue Projection Calculator!

Click HereSales Growth Calculator

Chart your sales trajectory skyward! Track your growth rate and see your business blossom with this calculator!

Click HereSales Margin Calculator

Squeeze more profit from every sale! Track your margins with this calculator!

Click HereSales Pipeline Calculator

Map your sales journey! Track your progress through the pipeline with this handy calculator!

Click HereSales Pipeline Coverage Calculator

Gauge your sales health in a flash! Track how many deals you need to close to hit your target with this calculator!

Click HereSales Velocity Calculator

Watch your sales engine roar! Track your velocity and see revenue climb!

Click HereSales Win Rate Calculator

Turn victories into a winning percentage! Track your success rate with this Win Rate Calculator!

Click HereSmall Business Loan Calculator

Secure your small business loan like a pro! Plan smart, manage costs, and watch profits grow!

Click HereStartup Cost Calculator

Map your launch costs with confidence! Plan smart and save with this startup calculator!

Click HereTime to Payback Customer Acquisition Cost (CAC) Calculator

See how fast your customers turn into cash machines! Track your payback time with this CAC calculator!

Click HereTotal Sales Calculator

Tally your triumphs! Track total sales and watch your business boom!

Click HereValue-Added Tax (VAT) Calculator

Ditch VAT woes! Calculate your tax burden with ease, like a financial ninja!

Click HereWorking Capital Calculator

Balance your business flow! Track working capital and keep your finances thriving!

Click HereProfit Margin Calculator FAQs

1. What exactly is profit margin, and how do you calculate it?

Think of it as the "success meter" for your business's income generation. There are three main types of profit margin:

- Gross profit margin: (Revenue - Cost of Goods Sold) / Revenue * 100%

- Operating profit margin: (Operating Profit) / Revenue * 100%

- Net profit margin: (Net Profit) / Revenue * 100%

Example: A company with $100,000 in revenue, $60,000 in cost of goods sold, and $20,000 in operating expenses has:

- Gross profit margin: (100,000 - 60,000) / 100,000 * 100% = 40%

- Operating profit margin: (20,000) / 100,000 * 100% = 20%

- Net profit margin: (10,000) / 100,000 * 100% = 10%

2. What's considered a "good" profit margin?

It depends! Industry benchmarks vary significantly. A 10% net profit margin might be good for retail, while tech companies might aim for 20% or higher. Consider these factors:

- Industry averages: Compare your margin to similar businesses in your field.

- Business stage: Startups might prioritize growth over immediate high margins.

- Financial goals: Align your margin target with your desired level of profitability and reinvestment.

3. Why is profit margin important for businesses?

It serves several crucial roles:

- Financial health: A healthy margin indicates efficient operations and ability to withstand economic downturns.

- Investor attractiveness: High margins attract investors interested in profitable businesses.

- Pricing decisions: Understanding your margin helps set prices that cover costs and generate profit.

- Performance evaluation: Track margin trends to identify areas for improvement and measure progress.

4. How can I improve my profit margin?

Multiple strategies can help:

- Increase revenue: Sell more products, attract new customers, or raise prices strategically.

- Reduce costs: Minimize waste, negotiate better deals with suppliers, and optimize operations.

- Improve product offerings: Enhance features, address customer needs, or develop higher-margin products.

- Streamline operations: Implement technology, automate processes, and improve workflows.

- Optimize marketing and sales: Target the right audience, improve conversion rates, and leverage cost-effective channels.

Remember, the best approach depends on your specific business and situation.

5. What are some common mistakes to avoid when managing profit margin?

- Focusing solely on cost-cutting: Neglecting product quality, customer service, or employee morale can backfire in the long run.

- Ignoring market trends: Failing to adapt to changing customer preferences or industry landscape can hinder growth.

- Rushing into unproven strategies: Carefully evaluate potential risks and returns before implementing major changes.

- Neglecting long-term vision: Prioritize sustainable growth over short-term gains.

6. Can small businesses benefit from focusing on profit margin?

Absolutely! Every business, regardless of size, should manage its profitability. Even small improvements in margin can significantly impact your cash flow and growth potential.

Example: A small restaurant implementing cost-saving measures on ingredients and optimizing its delivery routes can see a noticeable difference in its bottom line.

7. Should I prioritize gross profit margin, operating profit margin, or net profit margin?

Each metric offers valuable insights:

- Gross profit margin: Indicates efficiency in converting sales to profit before operating expenses.

- Operating profit margin: Takes operating expenses into account, reflecting overall operational efficiency.

- Net profit margin: Reflects your final profit after all expenses, including taxes and interest.

Consider all three margins to paint a holistic picture of your business's profitability and identify areas for improvement.

8. Are there any tools or resources to help me track and analyze my profit margin?

Several resources can be valuable:

- Accounting software: Track expenses, revenue, and calculate margins automatically.

- Industry reports and benchmarks: Compare your margins to industry averages for insights.

- Financial consultants or advisors: Seek expert guidance tailored to your business.

- Online courses and workshops: Learn from experienced professionals and successful entrepreneurs.

Remember, the most valuable tool is your own understanding of your business's financials and operations.

9. How can I use profit margin analysis to make strategic decisions?

By analyzing trends and comparing margins across different product lines, customer segments, or time periods, you can:

- Identify underperforming areas: Spot products, channels, or customer segments with low margins for improvement.

- Evaluate pricing strategies: Assess if prices adequately cover costs and generate desired profit.

- Make informed investments: Prioritize investments that promise higher returns on your profit margin.

- Forecast future profitability: Project future financial performance based on historical margins and planned changes.

Strategic use of profit margin analysis empowers you to make data-driven decisions that drive business growth and profitability.

10. What are some real-world examples of companies successfully managing their profit margins?

- Amazon: Increased efficiency and automation across its supply chain, resulting in consistent high margins.

- Apple: Maintains premium pricing and focuses on high-end products, leading to industry-leading profit margins.

- Southwest Airlines: Low-cost operational model and strong customer loyalty translate to healthy profit margins.

These examples showcase different approaches to achieving profitability, highlighting the importance of tailoring strategies to your business model and industry.